Posco plans to separate hydrogen and nickel businesses into new subsidiaries Move aimed at turning South Korean steel giant green

Translated by Ryu Ho-joung 공개 2022-01-27 07:58:57

이 기사는 2022년 01월 27일 07:58 thebell 에 표출된 기사입니다.

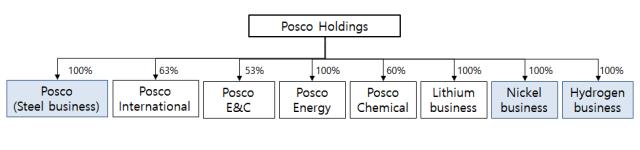

Posco plans to hive off its hydrogen and nickel businesses into new subsidiaries under a holding company structure, as the South Korean steel giant continues its push to turn itself green.“At the moment it is hard to say when (to separate them), rather we need to focus on growing new businesses now,” Kim Hak-dong, Posco’s vice chairman, recently told the bell at an event hosted by the Korea Enterprises Federation, suggesting that establishing those subsidiaries this year is unlikely.

Hydrogen and nickel businesses represent a tiny fraction of Posco’s revenue, with no separate financial details available.

Posco has been stepping up efforts to secure talent that will drive growth of new businesses, with three out of the company’s seven new executives recruited externally late last year being experts in hydrogen technology and secondary battery materials.

By 2030, Posco plans to grow its hydrogen business to a size equivalent to its mainstay steel unit, which accounts for nearly 50% of the company’s total revenue. To that end, the company will invest 10 trillion won ($8.3 billion) to expand its hydrogen production capacity to 500,000 tons per year by 2030.

“Posco will be one of the companies with the greatest hydrogen presence in the future,” Choi Jeong-woo, Posco’s chairman, told the bell at the H2 Mobility+Energy Show held in South Korea last September.

The steel giant also has doubled down on secondary battery materials. In April last year, it invested 150 billion won to establish a wholly owned lithium subsidiary, Posco Lithium Solution, in addition to Posco Argentina S.A.U. which also produces lithium.

Additionally, Posco plans to separate its nickel business to create a new wholly owned subsidiary. This could enable the broader Posco Group to strengthen its competitiveness in the secondary battery materials market as Posco Chemical produces cathode and anode materials whose raw materials include transition metals such as lithium and nickel.

Separating businesses into its new subsidiaries is subject to shareholder approval. In an effort to ease shareholder concerns about a potential decline in the parent company’s value, Posco said, “Even if hydrogen and nickel units are split off in the future, we would not list their shares on the stock market.”

“Fundraising will be led by the holding company and if needed, the holding company will raise additional funds through capital increase, rather than through initial public offerings of new subsidiaries.”

Meanwhile, it is likely that Posco will be able to secure sufficient support at an extraordinary shareholder meeting slated for Friday to shift to a holding company structure and split off its steel business into a wholly owned subsidiary.

The National Pension Service of South Korea, the steel giant’s largest shareholder with a roughly 10% stake, decided earlier this week to support Posco’s proposal.

Global proxy advisory firm Institutional Shareholder Service also recommended shareholders vote for the proposal. Foreign investors hold more than 50% of the company’s shares. (Reporting by Doung Yang)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- [2023 더벨 글로벌 투자 로드쇼-인도네시아]인니 정부, 친기업 정책 드라이브에 뜨거운 관심 '체감'

- [2023 더벨 글로벌 투자 로드쇼-인도네시아]"유망 스타트업 양성소, 글로벌 투자 거점 부상"

- [2023 더벨 글로벌 투자 로드쇼-인도네시아]"철저히 투자금융 관점서 봐야, 전략적 접근시 유리"

- [2023 더벨 글로벌 투자 로드쇼-베트남]신용보증기금, 중기 베트남 진출 지원에 팔 걷었다

- [2023 더벨 글로벌 투자 로드쇼-베트남]인프라·산업 투자 증가, 부동산 가격 상승 견인

- [2023 더벨 글로벌 투자 로드쇼-베트남]떠오르는 신규 투자처 '온실가스 감축 프로젝트'

- [2023 더벨 글로벌 투자 로드쇼-베트남]VITASK, 베트남 현지 기업 생산·기술력 개선 앞장

- [2023 더벨 글로벌 투자 로드쇼-베트남]급성장 '핀테크' 산업, 전자 결제·P2P·초단기 분야 각광

- [2023 더벨 글로벌 투자 로드쇼-베트남]진출 계획시 세무 접근 필요, '우대세율·감면' 활용해야 '득'

- [2023 더벨 글로벌 투자 로드쇼-베트남]한국이 투자 주춤할 때 태국은 과감히 '베팅'