Korean Air considers options for Asiana Airlines’ low-cost carrier Air Busan stake may be sold internally or externally to comply with fair trade regulations

Translated by Ryu Ho-joung 공개 2021-03-22 08:14:56

이 기사는 2021년 03월 22일 08:01 thebell 에 표출된 기사입니다.

Korean Air, part of the Hanjin Group, is considering multiple options for low-cost carriers owned by Asiana Airlines, as the country’s largest airline is outlining plans for post-merger integration with the second largest carrier.Korean Air Wednesday submitted to the state-controlled Korea Development Bank (KDB) its integration plans, which included options for the debt-ridden carrier’s low-cost arm Air Busan, according to industry sources.

In November last year, Hanjin KAL, the holding company of the Hanjin Group, reached an agreement with KDB, the main creditor of Asiana Airlines, to acquire the struggling carrier through Korean Air in the largest deal ever in the country’s aviation industry. At the time, the two parties said the deal was expected to close in the second half of 2021.

There is no change in the timeline, according to sources. But even if the deal is completed as scheduled, the launch of a combined entity of Korean Air and Asiana Airlines will likely take time because of restructuring efforts to streamline redundant operations and overlapped routes.

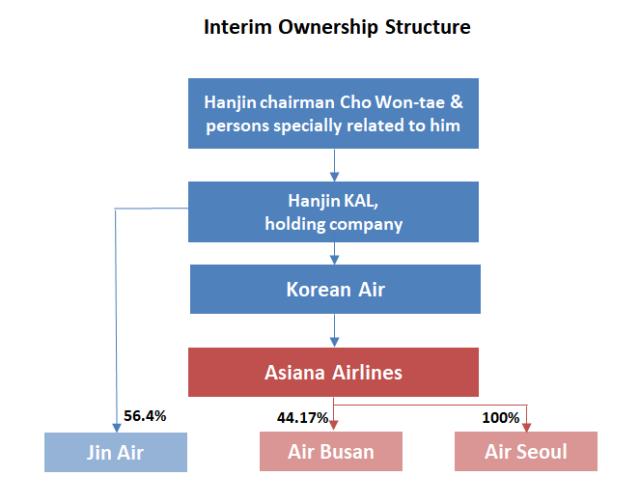

In the interim, Asiana Airlines will remain as a subsidiary of Korean Air, which would make it a second-tier subsidiary of Hanjin KAL. This could pose an issue for the conglomerate’s ownership structure because the country’s fair trade regulations require a holding company’s second-tier subsidiary – i.e. Asiana Airlines in this case – to own 100% of its subsidiaries.

Asiana Airlines has two low-cost arms, Air Seoul and Air Busan. It owns 100% of Air Seoul, while holding only a 44.17% stake in Air Busan.

Observers have been skeptical about the likelihood of Asiana Airlines purchasing the remaining stake in publicly-traded Air Busan, with some expecting that a merger between Air Busan and Jin Air, Korean Air’s low-cost arm, is more likely.

Another option is that Hanjin KAL or Korean Air buys Asiana Airlines’ stake in Air Busan, which would make the low-cost carrier the first or second-tier subsidiary of Hanjin KAL. According to fair trade regulations revised last year, a holding company is required to hold 30% or more of its first and second-tier subsidiaries.

“The situation is up in the air. (Korean Air and KDB) are considering a range of options including a merger or sale,” a person close to the matter said. “If they choose to sell (Asiana Airline’s stake in Air Busan), they could try to find an outside investor or sell it to higher-level companies (within Hanjin’s ownership structure).”

He added: “All options will be discussed based on the key principles, which are to retain jobs and create synergies.”

KDB is expected to review Korean Air’s integration plans over the coming month. Korean Air is said to have frequently communicated with KDB before presenting its plans. The airline is working with law firms including Kim & Chang and Yoon & Yang. (Reporting by Gyoung-tae Kim)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

best clicks

최신뉴스 in 전체기사

-

- [2023 더벨 글로벌 투자 로드쇼-인도네시아]인니 정부, 친기업 정책 드라이브에 뜨거운 관심 '체감'

- [2023 더벨 글로벌 투자 로드쇼-인도네시아]"유망 스타트업 양성소, 글로벌 투자 거점 부상"

- [2023 더벨 글로벌 투자 로드쇼-인도네시아]"철저히 투자금융 관점서 봐야, 전략적 접근시 유리"

- [2023 더벨 글로벌 투자 로드쇼-베트남]신용보증기금, 중기 베트남 진출 지원에 팔 걷었다

- [2023 더벨 글로벌 투자 로드쇼-베트남]인프라·산업 투자 증가, 부동산 가격 상승 견인

- [2023 더벨 글로벌 투자 로드쇼-베트남]떠오르는 신규 투자처 '온실가스 감축 프로젝트'

- [2023 더벨 글로벌 투자 로드쇼-베트남]VITASK, 베트남 현지 기업 생산·기술력 개선 앞장

- [2023 더벨 글로벌 투자 로드쇼-베트남]급성장 '핀테크' 산업, 전자 결제·P2P·초단기 분야 각광

- [2023 더벨 글로벌 투자 로드쇼-베트남]진출 계획시 세무 접근 필요, '우대세율·감면' 활용해야 '득'

- [2023 더벨 글로벌 투자 로드쇼-베트남]한국이 투자 주춤할 때 태국은 과감히 '베팅'