MBK’s stake sale may fetch big bucks to three Korean partners Three partners including co-founder Michael Kim owns 80% of PE firm’s Korean entity

Translated by Ryu Ho-joung 공개 2022-01-17 07:43:43

이 기사는 2022년 01월 14일 08:10 thebell 에 표출된 기사입니다.

MBK Partners, a North Asia-focused private equity firm, has agreed to sell a minority stake to US-based Dyal Capital Partners, a division of Neuberger Berman, in a deal that marks the first stake purchase by a global asset manager in an Asian private equity firm.The Seoul-headquartered firm agreed to sell a roughly 13% stake to Dyal Capital for $1 billion, according to a report by Bloomberg News on Wednesday.

A MBK Partners spokesman confirmed the sale, but declined to comment on details about the transaction.

MBK Partners is one of Asia’s biggest private equity firms, with buyout and special situations as its core strategy. It has offices in Beijing, Hong Kong, Seoul, Shanghai and Tokyo.

While details of the deal have not been disclosed, industry watchers say it is likely that most of the stake purchased by Dyal Capital belonged to existing shareholders of MBK Partners’ South Korean entity.

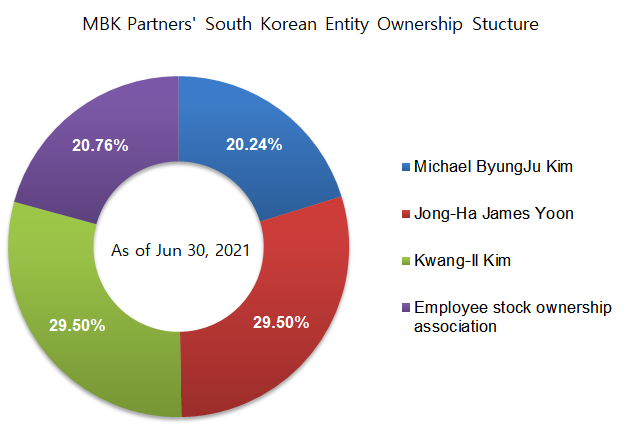

Investments by the firm’s South Korea team reportedly represent about 50% of its total portfolio. According to financial statements for the year ended on June 30, 2021, the South Korean entity was 20.24% owned by Michael ByungJu Kim, the private equity firm’s co-founder and partner, and 29.5% each owned by partners Jong-Ha James Yoon and Kwang-Il Kim.

Assuming that the deal was structured to include part of the holdings in MBK Partners’ all entities on a pro rata basis, the stake sale would enable the three partners – who together own a nearly 80% of the South Korean entity – to cash out more than $100 million each.

The deal comes amid a boom in M&A activity across Asia. MBK Partners, which focuses on investments in Greater China, Japan and South Korea, completed successful exits in all three countries last year.

New York-based Dyal Capital focuses on acquiring minority stakes in established asset managers. The stake sale is expected to help MBK Partners to expand beyond Asia into Europe and the US. (Reporting by Hyo-jung Lim)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- [아시아나 화물사업부 M&A]MBK 손잡은 에어프레미아, 다크호스 등극

- [대기업 프로스포츠 전술전략]전북현대, '돈방석' 기회 끝내 놓쳤다

- 골프존, 주가 하락에 발목잡혔나…GDR 분할 '무산'

- [Art Price Index]시장가치 못 찾은 퍼포먼스 작품

- 하이브 '집안싸움'이 가리키는 것

- 이익률 업계 톱인데 저평가 여전…소통 강화하는 OCI

- KB금융, 리딩금융의 품격 ‘주주환원’ 새 패러다임 제시

- 대외 첫 메시지 낸 최창원 의장의 속내는

- KG모빌리티, 라인 하나로 전기차까지

- [이사회 분석]갈 길 바쁜 LS이브이코리아, 사외이사 없이 간다