CJ’s heir apparent pledges more shares for loan taken by C&I Leisure Industry Company is owned by fourth generation of Korean conglomerate’s controlling Lee family

Translated by Ryu Ho-joung 공개 2022-02-09 08:11:40

이 기사는 2022년 02월 09일 08:08 thebell 에 표출된 기사입니다.

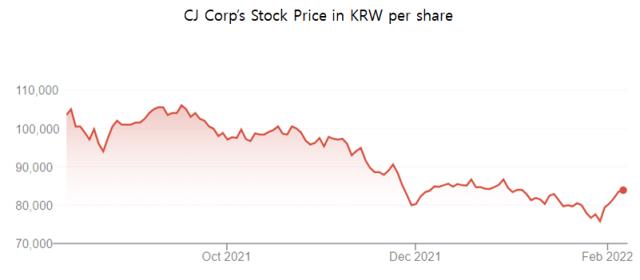

Lee Sun-ho, the son of South Korean conglomerate CJ Group’s chairman Lee Jay-hyun, has pledged more of his shares in CJ Corp against loans taken by C&I Leisure Industry, as the falling price of the holding company’s stock has reduced the value of collateral.In a regulatory filing last week, C&I Leisure Industry said that Lee Sun-ho provided 240,000 preferred shares in CJ Corp on January 28 – worth approximately 17 billion won ($14 million) based on the day’s closing price – as additional collateral for loans taken out by the company.

C&I Leisure Industry is wholly owned by the fourth generation of CJ Group’s controlling Lee family, with the conglomerate’s heir apparent Sun-ho and his sister, Kyung-hoo, holding 51% and 24% stakes in the company respectively at the end of 2020.

The family-owned company, established in 2006, has raised operating funds mostly through loans backed by the Lee family’s personal assets. In November 2008, chairman Lee provided 600,000 shares in CJ Corp as loan collateral for the company. In November 2020, the Lee siblings each provided 12,000 shares in the holding company.

Lee Sun-ho additionally pledged his preferred shares in CJ Corp last month because, with expected rate hikes weighing on the stock market, CJ Corp shares continued to slide this year, resulting in a reduction in the value of collateral.

“(Lee Sun-ho) provided additional collateral after considering the possibility of the stock price going down further,” an official at CJ Group said.

C&I Leisure Industry borrowed a total of 35.9 billion won from Korea Securities Finance Corp at an interest rate of around 2% by using the Lee family’s assets as collateral. The loans represented nearly two-thirds of the company’s total assets of 55.3 billion won at the end of 2020 on a non-consolidated basis.

The company has used the loan proceeds for its offshore wind power project in Gureop Island in Incheon, with an aim to break ground in 2024 and complete the construction in 2025. The project is pending regulatory approvals. (Reporting by Hyo-beom Lee)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- 스튜디오산타클로스ENT, 주주권익 보호 '구슬땀'

- 이에이트, AI 시뮬레이션·디지털 트윈 기술 선보여

- MBK, '몸값 2조' 지오영 인수 SPA 체결 임박

- [2024 더벨 글로벌 투자 로드쇼-베트남]한인이 설립한 RCE, 세계 첫 ‘중장비 온라인 중고거래’

- 회계법인 해솔, 부동산 타당성 자문 업무협약

- [2024 더벨 글로벌 투자 로드쇼-베트남]베트남의 지오영 '바이메드'·전기오토바이 '셀렉스' 눈길

- 지아이에스, 코스닥 상장 위한 예비심사신청서 제출

- [꿈틀대는 토큰증권 시장]'업계 표준' 루센트블록, '두자릿수' 레코드 조준

- [Company & IB]조달 '막바지' 롯데그룹, 롯데케미칼에 쏠리는 눈

- '910억 CB 발행' 아스트, 경영 정상화 속도 낸다