Kakao Pay’s IPO could value it at as high as $16 bln Analysts are optimistic about its business model focused on platform ecosystem

Translated by Ryu Ho-joung 공개 2021-05-12 08:04:24

이 기사는 2021년 05월 12일 07시50분 thebell에 표출된 기사입니다

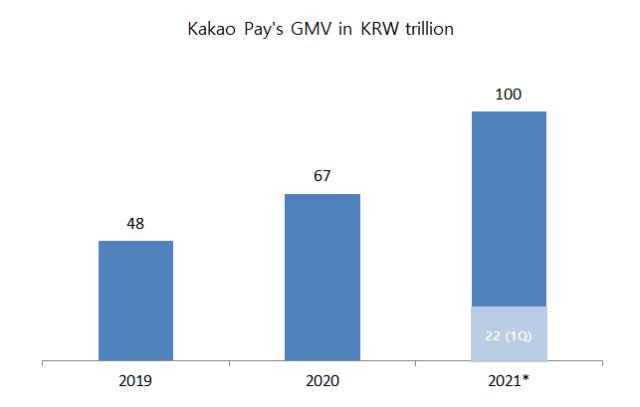

The planned initial public offering of Kakao Pay may value Kakao’s payment business at as much as 18 trillion won ($16 billion), according to estimates by analysts, underlining the promising growth prospects of the company.Analysts have put the company’s valuation at between 10 trillion won and 18 trillion won. The highest 18 trillion won valuation, estimated by eBest Investment & Securities, represents 0.18 times the company’s expected gross merchandise value (GMV) for 2021.

Kakao Pay’s GMV grew 40% year on year to 67 trillion won in 2020. GMV for the first quarter of this year came in 22.8 billion won, with the full-year figure expected to reach 100 trillion won.

Typically, the price to book ratio is used to value financial services firms. But GMV has been used for the valuation of Kakao Pay because of its business model focused on a platform ecosystem. A platform company, like Kakao Pay, needs heavy investment in resources in early years. But once its business ecosystem is formed, growth in revenue and earnings can accelerate dramatically.

Kakao Pay has partnerships with many other financial services firms – such as banks, credit card companies, insurers and brokerage firms – which sell their offerings on Kakao Pay’s platform. Continued growth in the platform’s users and GMV would allure more financial services firms to partner with the company, which in turn could lead to revenue growth.

Kakao Pay was spun off from Kakao in 2017. Its revenue grew 27-fold in the past three years, from 10.6 billion won in 2017 to 284.4 billion won 2020. Operating loss was reduced from 96.5 billion won in 2018 to 17.9 billion won in 2020, with the company expected to turn profitable this year.

Meanwhile, SK Securities and Shinhan Investment estimated Kakao Pay’s valuation to be 10.66 trillion won and 10.3 trillion won, respectively, based the company’s expected GMV this year.

KTB Investment & Securities estimated Kakao Pay to be worth 13.2 trillion won based on monthly active users (MAU). The valuation is equal to revenue per MAU of 737,000 won multiplied by the company’s MAU, which is expected to grow to 17.9 million this year. (Reporting by Hana Suh)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

best clicks

최신뉴스 in 전체기사

-

- '비상경영체 돌입' SKT, 유심 사태 수습 '총력전'

- 위메이드 "위믹스 해킹 늑장공시 아니야…DAXA 기준 불분명"

- [Market Watch]DN솔루션즈 이어 롯데글로벌까지, 대형 IPO '휘청'

- [롯데글로벌로지스 IPO]흥행 실패 우려, 결국 상장 철회로 귀결

- [AACR 2025]제이인츠 'JIN-001', 독성 최소화한 '저농도' 효능 입증

- [Financial Index/SK그룹]주가상승률 50% 상회, SK스퀘어 'TSR' 그룹내 최고

- 금호타이어, 분기 '최대 매출'…영업이익은 '주춤'

- 유지한 SKC CFO "트럼프 관세, 위기보다 기회"

- [i-point]신테카바이오, 'K-BioX 글로벌 SUMMIT 6' 참여

- 간추려진 대명소노그룹 선택지, '티웨이'에 집중