Kurly’s pre-IPO round attracts investors despite valuation concerns Private equity investors expect online delivery platform to swing to profit in couple of years

Translated by Ryu Ho-joung 공개 2021-05-20 08:12:46

이 기사는 2021년 05월 20일 08시04분 thebell에 표출된 기사입니다

Several investors are considering investing in Kurly, which operates online grocery delivery platform Market Kurly, against earlier expectations that concerns about the company’s high valuation may reduce interest from investors.Multiple private equity firms are conducting due diligence on Kurly, which is seeking to raise a total of 300 billion won ($264 million) from new investors in a private placement, industry sources said. Morgan Stanley is advising Kurly on the fundraising process.

Kurly is reportedly seeking a pre-money valuation of 3 trillion won, more than triple its valuation of 900 billion won in a previous funding round where the company raised 200 billion won.

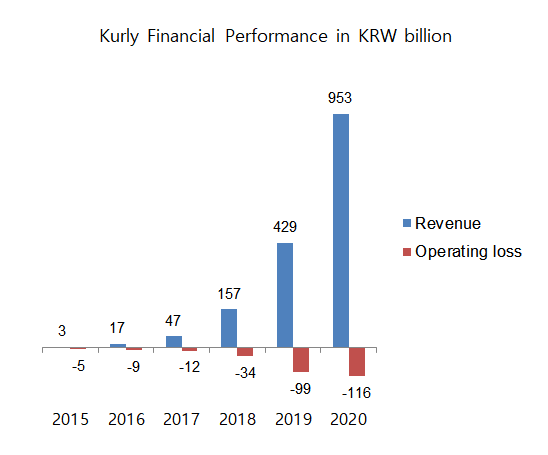

As its overnight delivery service gained popularity with online consumers, Kurly’s revenue has grown at an annual average rate of more than 200% for the past five years, reaching 953 billion won in 2020. But the company also saw its operating loss increase in the same period, from 5 billion won in 2015 to 116 billion won in 2020, with a cumulative loss of 270 billion won.

Kurly, which is preparing for an initial public offering, will likely use money from new investors to further expand its business and thus increase enterprise value. The Seoul-based startup is stepping up efforts to diversify beyond grocery, increasing home appliances and beauty product offerings on its platform. It is also planning to expand to include lodging reservation and home appliance rental services.

There were concerns that the company’s high valuation and rising competition from large retail conglomerates might dissuade investors from investing in Kurly. However, several private equity investors interested in buying shares in Kurly reportedly expect it to swing to a profit in two to three years if the company expands its overnight delivery service beyond the Seoul metropolitan area and continues to increase its logistics capacity.

Kurly has not decided on the listing venue. Expectations were high that Kurly could list its shares in the US after the company canceled a contract with Samsung Securities and hired foreign investment banks Goldman Sachs, Morgan Stanley and JP Morgan to lead an IPO earlier this year.

Sophie Kim, founder and chief executive of Kurly, may prefer a US listing because of a dual-class share structure, which is not allowed in South Korea. Kim’s stake in Kurly has been diluted to 6.6% following rounds of funding in the past years. The structure would enable Kim to retain control of the company despite her tiny stake.

Rival Coupang’s successful debut on the New York Stock Exchange in March has apparently also encouraged Kim to turn her eyes to the much bigger US market. However, Kurly may find it difficult to follow suit because of its ever increasing losses.

If Kurly decides to float locally, which will be less costly compared to a US listing, the company would likely list on the junior Kosdaq, which allows listing of loss-making companies with strong growth prospects. (Reporting by Si-eun Park)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- [i-point]바이오솔루션, ‘카티라이프’ 미국 임상 2상 성공

- '돋보인 해외성장' 에이피알, 1분기에도 역대 최대 실적

- [i-point]'턴어라운드' 가온그룹, 와이파이7 선점 효과

- [i-point]라온메타-마인즈AI, 의사 국가고시 실기시험 제공

- [레페리는 지금]기업가치 산정 '고차방정식', 성장성 인정받을까

- [지앤푸드는 지금]계열 리스크 일단락…비상장사 관리 숙제 여전

- '지분 수증' 신세계 정유경 회장, 남매의 뚜렷한 '대비'

- [지배구조 분석]지주사 체제 정비 삼양식품, 중장기 승계 포석

- [지배구조 분석]삼양라운드스퀘어, 416억 지분 매입 '보유 현금' 활용

- [주주 프렌드십 포커스]현대지에프홀딩스, TSR 40% 육박…플러스 전환 성공