Kakao capitulates to pressure from regulators and politicians Korean tech giant plans to improve governance and focus on social responsibility efforts

Translated by Ryu Ho-joung 공개 2021-09-16 08:08:22

이 기사는 2021년 09월 16일 08시07분 thebell에 표출된 기사입니다

South Korea’s Kakao Group has announced a major overhaul to improve its governance and address its social responsibility, succumbing to escalating pressure from regulators and politicians on the online platform giant.The overhaul, announced on Tuesday, includes restructuring the group’s businesses to focus on innovative areas and refrain from expansion that could hurt the local economy; creating a 300 billion won ($256 million) fund for the next five years to support its smaller business partners; and strengthening K Cube Holdings’ commitment to social responsibility.

The revamp comes after increased regulatory scrutiny targeting the tech giant over the last few days. Especially, Korea Fair Trade Commission, the country’s competition watchdog, has recently launched investigations of potentially faulty information on K Cube Holdings submitted by Kim Beom-su, Kakao’s founder and chairman, and possible monopoly violations.

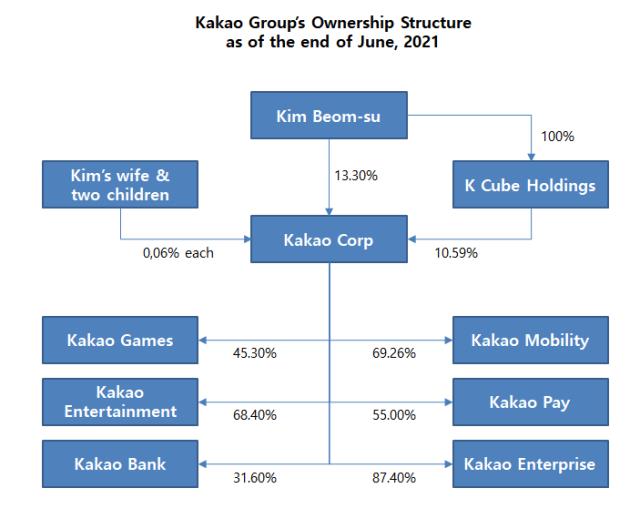

The most notable about the group’s plans are changes to K Cube Holdings, Kakao’s de facto holding company.

K Cube Holdings, which is wholly owned by Kim, holds a 10.59% stake in Kakao Corp. This, along with his 13.3% stake in Kakao Corp, enables Kim to solidify his control over the group.

K Cube Holdings has only seven employees, with more than half of them consisting of Kim’s family members including his wife and two children. They will leave the company as part of the revamp.

K Cube Holdings’ role in the group has not been clear so far. The company, established in 2007, only started to generate revenues in 2018 through dividends and gains from small venture capital investments.

But in the future, K Cube Holdings will likely shift its focus to socially responsible investing beyond venture capital investments as Kakao Group pledged it would transform K Cube Holdings into a company that creates social value.

There is also a possibility that K Cube Holdings could manage the group’s 300 billion won fund designed to support its business partners. Kakao’s affiliates are expected to put a combined about 60 billion won into the fund over the next five years, which represents approximately 13% of Kakao Corp’s consolidated operating profit of 456 billion won in 2020.

“K Cube Holdings will be transformed into a company that prioritizes social value over financial returns, although details have yet to be finalized,” said an official at Kakao Group. “Chairman Kim’s family members will leave the company.” (Reporting by Seul-gi Kim)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- [Market Watch]DN솔루션즈 이어 롯데글로벌까지, 대형 IPO '휘청'

- [롯데글로벌로지스 IPO]흥행 실패 우려, 결국 상장 철회로 귀결

- [AACR 2025]제이인츠 'JIN-001', 독성 최소화한 '저농도' 효능 입증

- [Financial Index/SK그룹]주가상승률 50% 상회, SK스퀘어 'TSR' 그룹내 최고

- 금호타이어, 분기 '최대 매출'…영업이익은 '주춤'

- 유지한 SKC CFO "트럼프 관세, 위기보다 기회"

- [i-point]신테카바이오, 'K-BioX 글로벌 SUMMIT 6' 참여

- 간추려진 대명소노그룹 선택지, '티웨이'에 집중

- [감액배당 리포트]제주항공, 신속한 885억 감액…배당은 못했다

- [중간지주 배당수익 분석]세아베스틸지주, 배당수익 3배 급증...분할회사도 첫 기여