Samsung Life set to avoid chaebol regulations with the Lee family’s share sale Lee Seo-hyun, daughter of late Samsung chairman, will sell part of her stake in insurer

Translated by Ryu Ho-joung 공개 2021-10-14 08:06:35

이 기사는 2021년 10월 14일 08시03분 thebell에 표출된 기사입니다

Samsung’s controlling Lee family is set to sell part of their shares in the South Korean conglomerate’s key affiliates, reducing a collective stake in Samsung Life Insurance held by the family members, a move that will help the insurer to avoid increased scrutiny from the country’s competition regulator.Lee Seo-hyun, the younger daughter of Samsung’s late chairman Lee Kun-hee and chair of the Samsung Welfare Foundation, signed a contract on October 5 to sell 3,459,940 shares or a 1.73% stake in Samsung Life Insurance through a trust, industry sources said.

Her mother, Hong Ra-hee, and elder sister, Hotel Shilla’s chief executive Lee Boo-jin, will also dispose their 19,941,860 shares (0.33%) in Samsung Electronics and 1,509,430 shares (1.95%) in Samsung SDS, respectively, in the same way. Kookmin Bank will handle the sale of the shares on their behalf.

The decision is largely seen as part of efforts by the owner’s family to fund a massive inheritance tax bill of more than 12 trillion won ($10 billion), which was imposed after the three and Lee Jae-yong, the late chairman’s son and vice chairman of Samsung Electronics, inherited shares in the conglomerate’s key affiliates in April.

The share sale will also allow Samsung Life Insurance to avoid increased scrutiny expected from the Korea Fair Trade Commission (KFTC).

A revision of the country’s fair trade law, effective December 30, 2021, will make companies in which members of the owner’s family hold a combined 20% stake or more subject to tougher regulations in regard to business matters such as intercompany transactions. The threshold has been lowered from the current 30%.

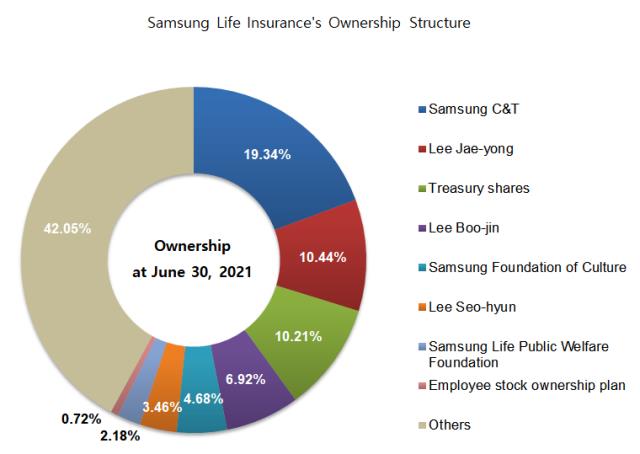

The Lee family together owns 20.82% of Samsung Life Insurance at the end of June this year. If the sale of Lee Seo-hyun’s 1.73% stake in the insurance company is completed, their ownership interest will decline to 19.09%, slightly below the new threshold of 20%.

This will enable Samsung’s financial services affiliates to avoid tougher regulations from the KFTC. Samsung Life Insurance’s subsidiaries include Samsung Card, Samsung Asset Management, Samsung Life Service Claim Adjustment, Samsung Financial Service Insurance Agency and Samsung SRA Asset Management.

Any violation of the competition law, especially in regard to intercompany transactions for the purpose of wealth preservation of the owner’s family, could put a conglomerate at major legal risk as its head can be reported to prosecutors.

“I think the share sale is aimed both at raising funds to pay inheritance tax and avoiding stricter scrutiny from the KFTC,” said an industry insider.

It is likely that Samsung Life Insurance will accelerate new businesses going forward. Samsung’s four financial services affiliates, including Samsung Life Insurance and Samsung Card, in April announced a plan to spend a combined more than 30 billion won to jointly build an integrated platform for their clients.

The announcement came as the insurer’s entry into the MyData business has been delayed due to the financial regulator’s pending decision on the company’s handling of intercompany transactions. (Reporting by Eun-sol Lee)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- [i-point]'자가면역질환 신약' 이노보테라퓨틱스, 미국 임상 1상 '성공적'

- [i-point]폴라리스오피스, 엔비디아 ‘커넥트’ 공식 파트너 선정

- [i-point]신성이엔지, 한국종합기술·다스코와 연료전지 발전사업 협약

- [i-point]신테카바이오, 'PEGS 보스턴 2025' 참가

- [AACR 2025]첫 구두발표 진씨커, 경쟁사 넘보는 '유전자가위 액체생검'

- [AACR 2025]이뮨온시아 'CD47' 안전성 굳히기 "경쟁약과 다르다"

- [AACR 2025]항암 신약 항체 대신 '페라틴', 셀레메디 플랫폼 데뷔전

- [AACR 2025]근거 쌓는 '루닛 스코프' 빅파마 공동연구 쇼케이스

- [변곡점 선 콜마비앤에이치]변화의 마지막 카드, 경영진 교체 '강수' 두나

- [변곡점 선 콜마비앤에이치]속절없는 주가 하락 '트리거', 주가 부양 의지 없었나