Korean Air’s assets sale plan one step closer to completion Airline’s board approves $470 million land sale to state-controlled land agency

Translated by Ryu Ho-joung 공개 2021-12-28 08:10:09

이 기사는 2021년 12월 28일 08시08분 thebell에 표출된 기사입니다

Korean Air Lines has been one step closer to completing its assets sale plan after successfully selling its land in central Seoul, bringing in a total of over 1.4 trillion won ($1.2 billion) from a string of divestments of non-core assets in the past two years.The flag carrier’s board of directors approved the sale of the company’s land in Jongno District in central Seoul to the Korea Land & Housing Corporation (LH) for 557.8 billion won on Thursday. The deal is expected to close in June next year.

The sale comes almost two years after Korean Air announced its restructuring plan in February 2020 to improve its liquidity position. The company specifically mentioned the land and Wangsan Marina as candidates for sale.

In June last year, however, the Seoul Metropolitan Government unexpectedly revealed a plan to turn the land into a public park, making the city government the only potential buyer for the land.

LH was involved in discussions between the carrier and the Seoul city government, and the three parties reached an agreement on the deal in which LH will buy Korean Air’s land on behalf of the city government, which in return will grant LH the city’s public land in Samseong-dong in southern Seoul.

The proceeds from the land sale is expected to help to improve the airline's financial health. Korean Air already has seen a significant improvement in the financial condition in the past two years through continued asset sales amid the Covid-19 pandemic’s crippling impact on the airline industry.

Korean Air sold its in-flight catering service to Seoul-based private equity firm Hahn & Co in December 2020 in a deal estimated to be worth about 900 billion won. It also divested its limousine bus business in a 9.6 billion won deal in February this year.

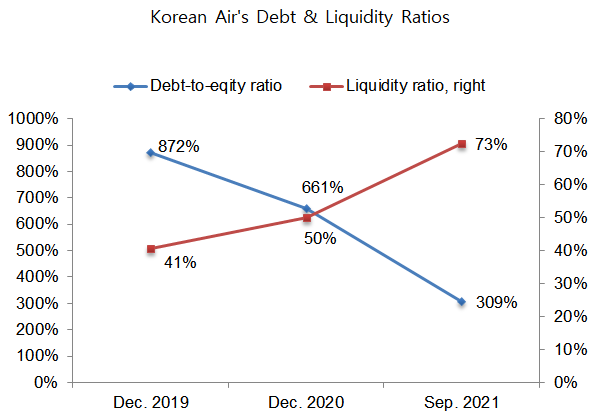

The airline’s liquidity ratio improved from 40.7% at the end of December 2019 to 72.5% at the end of September this year. Its debt-to-equity ratio also declined significantly, from 871.5% to 308.6%, in the same period. A large capital injection – as part of the deal with the state-controlled Korea Development Bank to acquire rival Asiana Airlines – also contributed to an improvement in the financial position.

‘Now most of the assets included in Korean Air’s restructuring plan have been sold,” an industry insider said. “The airline’s financial health will further improve if it finds a buyer for Wangsan Marina.”

The book value of Wangsan Marina was approximately 110.8 billion won at the end of September this year. Korean Air had been in talks with Consus Asset Management about a sale in October but they failed to reach an agreement. It intends to continue to look for a buyer for the asset. (Reporting by Doung Yang)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- [Market Watch]DN솔루션즈 이어 롯데글로벌까지, 대형 IPO '휘청'

- [롯데글로벌로지스 IPO]흥행 실패 우려, 결국 상장 철회로 귀결

- [AACR 2025]제이인츠 'JIN-001', 독성 최소화한 '저농도' 효능 입증

- [Financial Index/SK그룹]주가상승률 50% 상회, SK스퀘어 'TSR' 그룹내 최고

- 금호타이어, 분기 '최대 매출'…영업이익은 '주춤'

- 유지한 SKC CFO "트럼프 관세, 위기보다 기회"

- [i-point]신테카바이오, 'K-BioX 글로벌 SUMMIT 6' 참여

- 간추려진 대명소노그룹 선택지, '티웨이'에 집중

- [감액배당 리포트]제주항공, 신속한 885억 감액…배당은 못했다

- [중간지주 배당수익 분석]세아베스틸지주, 배당수익 3배 급증...분할회사도 첫 기여