MBK Partners-owned Homeplus taps ABS to raise liquidity Korean retail chain to raise $340 mil by issuing debt backed by security deposits

Translated by Ryu Ho-joung 공개 2021-08-19 08:04:02

이 기사는 2021년 08월 19일 08:02 thebell 에 표출된 기사입니다.

South Korean supermarket chain Homeplus, owned by private equity firm MBK Partners, is set to raise about 400 billion won ($339.8 million) from issuing debt backed by security deposits in an effort to increase liquidity amid deteriorating financial performance.The hypermarket operator is preparing to sell debt backed by security deposits paid to building owners by its 50 outlets nationwide to free up cash, industry sources said on Tuesday.

The securitization, valued at about 400 billion won in total, will be arranged by six financial services firms, all of which arranged refinancing for Homeplus in 2019.

Most of the proceeds will be used to refinance the company’s existing securitized debt of 330 billion won, which was sold in 2019 and also backed by a pool of security deposits paid by its stores. The remaining funds will be used for working capital.

There is another reason apart from raising cash that prompted Homeplus to return to the securitized debt market: concerns about a credit downgrade. The existing securitized debt has a covenant that forces Homeplus to repay debt before maturity if either the company’s long-term or short-term credit rating is lowered to BBB+ or A3+.

Major credit rating agencies in South Korea last year downgraded their short-term credit rating for Homeplus by one level to A2-, only one notch above A3+. They cited multiple reasons for the downgrade, including a downward trend in financial performance due to a shift in shopping behaviors and the company’s weakened financial health with limited prospects for recovery even after the Covid-19 pandemic is over.

The newly-issued debt will have a covenant that triggers early repayment if the company’s short-term credit rating is lowered to A3. It is likely Homeplus will have greater financial flexibility by refinancing the existing securitized debt with new debt with a more favorable covenant structure.

As of the end of February this year, Homeplus had total gross debt of 1.6 trillion won (excluding lease liabilities). Its cash and cash equivalents were 826 billion won and unused credit facilities were 292 billion won.

MBK Partners acquired Homeplus from UK’s Tesco for about 7.2 trillion won in 2015. The private equity firm at the time funded 4.3 trillion won through debt financing, about half of which was repaid over the following four years. The remaining 2 trillion won was refinanced in October 2019. The loan balance has since been further reduced by about 1 trillion won.

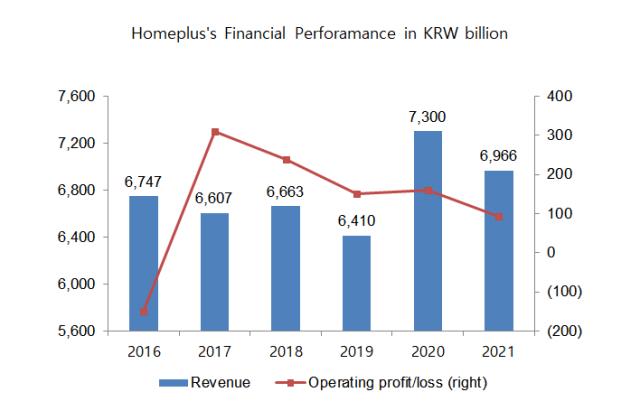

Homeplus has experienced reduced revenues since the pandemic began. It reported revenue of 6.97 trillion won for the year that ended February 28, 2021, down from 7.3 trillion won a year earlier. Earnings before interest, taxes, depreciation and amortization also fell by about 100 billion won to 566 billion won in the same period.

Korea Ratings said in its recent report that it is considered positive that Homeplus continues restructuring efforts to enhance operational efficiency. But the rating agency added that trends such as intensifying competition among online retailers, the company’s growing share of lower margin online sales and high fixed costs at its offline outlets will cloud the company’s recovery prospects even after the pandemic subsides. (Reporting by Hee-yeon Han)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- 우리금융 "롯데손보 M&A, 과도한 가격 부담 안한다"

- 신한캐피탈, 지속성장 포트폴리오 리밸런싱 체계 강화

- 하나금융, ELS 악재에도 실적 선방…확고한 수익 기반

- 하나금융, 자본비율 하락에도 주주환원 강화 의지

- 국민연금, '역대 최대 1.5조' 출자사업 닻 올렸다

- [도전 직면한 하이브 멀티레이블]하이브, 강한 자율성 보장 '양날의 검' 됐나

- [퍼포먼스&스톡]꺾여버린 기세에…포스코홀딩스, '자사주 소각' 카드 재소환

- [퍼포먼스&스톡]LG엔솔 예견된 실적·주가 하락, 비용 절감 '집중'

- [퍼포먼스&스톡]포스코인터, 컨센서스 웃돌았지만 주가는 '주춤'

- 신한금융, ‘리딩금융’ 재탈환에 주주환원 강화 자신감