SK Innovation to declare dividend after two years without payout Move seen as part of efforts to appease shareholders after split-off of battery unit

Translated by Ryu Ho-joung 공개 2022-02-07 07:45:41

이 기사는 2022년 02월 07일 07시37분 thebell에 표출된 기사입니다

SK Innovation, part of South Korean conglomerate SK Group, is set to pay dividend for 2021 after its board of directors decided to revisit its policy of making no dividend payment, a move seen as part of efforts by the company to appease shareholders after the split-off of its electric vehicle battery business, SK On, in October last year.“After heated debate, our board of directors voted against a proposal to pay no dividend for fiscal year 2021,” Kim Yang-seob, SK Innovation’s chief financial officer, said in an earnings call held at the end of January.

SK Innovation will declare dividend soon, with attention being drawn to how much of the company’s earnings will be paid out to shareholders after two years of halting dividend payments.

Some speculate SK Innovation may opt to pay dividend in stock instead of cash, especially considering that the company changed its articles of association last September to allow such payments.

Stock dividends allow a company to reward stockholders even when it is low on cash or needs to spend the bulk of its earnings on investments. They decrease retained earnings and increase paid-in capital by an equal amount, with no effect on the total amount of stockholders’ equity.

SK Innovation started to pay interim dividend in 2017 to increase shareholder returns in line with a shareholder return policy at the group level.

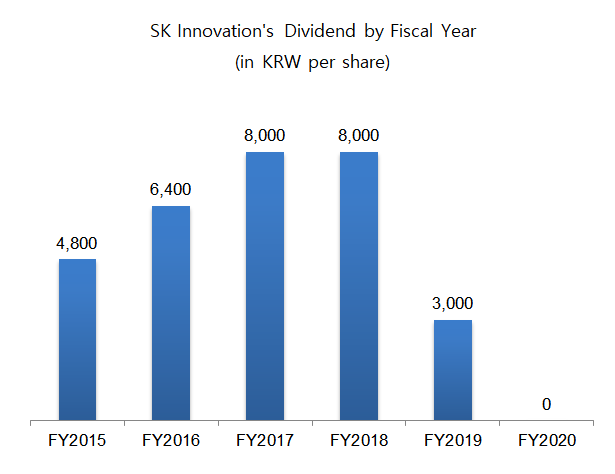

The company paid dividend of 8,000 won ($6.68) per share in both 2017 and 2018, up 25% from 6,400 won per share in 2016, with a payout ratio of 34.9% and 41.7% in 2017 and 2018 respectively on a consolidated basis.

However in 2019, the dividend was reduced to 3,000 won per share due in part to weak earnings. SK Innovation skipped dividend payments in the following year, and officially mentioned the possibility of reducing dividend payout onwards in its corporate governance report issued in 2021.

SK Innovation’s dividend income from its subsidiaries represents the bulk of its operating cash flow, with the company collecting 1.5 trillion won and 1.9 trillion won in dividend income in 2019 and 2020 respectively.

But last year the company offloaded a 40% stake in its lubricants unit, SK Lubricants, which paid 500 billion won and 350 billion won in dividend in 2019 and 2020 respectively. SK Geo Centric, another subsidiary of SK Innovation, paid 300 billion won in dividend in 2019 but made no dividend payments in the following year.

SK Innovation reported strong earnings in 2021, generating 46.8 trillion won in revenue and operating profit of 1.76 trillion won, a sharp reversal from its 2.4 trillion won loss a year ago.

Its cash position is also good, with the company raising 1.1 trillion won from a minority stake sale in SK Lubricants to a private equity firm in April last year and securing 1.35 trillion won by selling shares in the initial public offering of SK IE Technology in May.

Yet, the company is preparing for an aggressive expansion, with a plan to invest 17 trillion won over the next five years in areas like batteries and battery materials. (Reporting by Eun-a Jo)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- '비상경영체 돌입' SKT, 유심 사태 수습 '총력전'

- 위메이드 "위믹스 해킹 늑장공시 아니야…DAXA 기준 불분명"

- [Market Watch]DN솔루션즈 이어 롯데글로벌까지, 대형 IPO '휘청'

- [롯데글로벌로지스 IPO]흥행 실패 우려, 결국 상장 철회로 귀결

- [AACR 2025]제이인츠 'JIN-001', 독성 최소화한 '저농도' 효능 입증

- [Financial Index/SK그룹]주가상승률 50% 상회, SK스퀘어 'TSR' 그룹내 최고

- 금호타이어, 분기 '최대 매출'…영업이익은 '주춤'

- 유지한 SKC CFO "트럼프 관세, 위기보다 기회"

- [i-point]신테카바이오, 'K-BioX 글로벌 SUMMIT 6' 참여

- 간추려진 대명소노그룹 선택지, '티웨이'에 집중