Samsung Biologics’ credit rating upgraded to AA- Customer base expansion and business diversification cited as reasons for upgrade

Translated by Ryu Ho-joung 공개 2022-05-10 08:20:29

이 기사는 2022년 05월 10일 08시13분 thebell에 표출된 기사입니다

Korea Ratings upgraded its credit rating on Samsung Biologics to AA- with a negative outlook on April 28, only eight months after the contract manufacturing organization (CMO) was first rated at A+ with a positive outlook in August last year.The South Korean credit rating agency cited the expansion of the company’s customer base as one of the reasons for the upgrade. Samsung Biologics signed long-term contracts with global pharmaceutical companies such as Moderna, AstraZeneca and Roche thanks to increased demand for contract manufacturing in the aftermath of the Covid-19 pandemic.

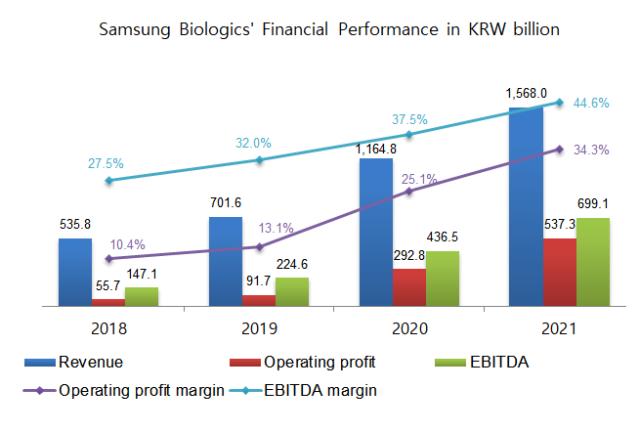

Revenue almost tripled to 1.56 trillion won ($1.22 billion) in 2021 from 535.8 billion won a year ago. Operating profit soared to 537.3 billion won, with an operating margin of 34.3%. Earnings before interest, tax, depreciation and amortization (EBITDA) margin also rose to 44.6%.

Samsung Biologics is currently building its fourth plant in Songdo, Incheon, where it has three factories with a combined production capacity of 364,000L a year. Korea Ratings expected the company’s fourth plant, which will become partially operational in October, to help enhance stability of operating cash flow.

The CMO has also diversified its business by taking over biosimilar manufacturer Samsung Bioepis as its wholly owned subsidiary. Samsung Bioepis’ operating profit margin and EBITDA margin were 22.8% and 30.4% respectively in 2021.

Despite continued capital spending, Samsung Biologics has no long-term debt thanks to money raised through its 3.2 trillion won capital increase in April. Of the proceeds, 2 trillion won will be spent on capital expenditure and the remaining amount will be used for the acquisition of Samsung Bioepis.

Samsung Biologics’ strong cash position and operating cash flow are credit positive, Korea Ratings said. The company’s cash reserves rose to 1.34 trillion won at the end of 2021 from 828.9 billion won a year ago driven by a sharp increase in operating profits.

Korea Ratings added the company’s debt levels need to continue to be monitored due to the uncertainty related to the development of biosimilars and new drugs. (Reporting by Ji-won Kim)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- [i-point]대동, 판매 채널 확대·제품 다변화에 1분기 해외 매출 증가

- 황철주 주성엔지 회장의 '혁신론'

- [i-point]메타랩스, 1분기 당기순손실 규모 축소

- [i-point]메타케어, 1분기 매출·영업이익 동반 성장

- 삼성·SK, '하이 NA EUV' 달라진 투자 셈법

- 엠케이전자, 원가부담에도 '영업익 전년비 45%↑'

- [i-point]파워넷, 분기 기준 역대 최대 실적 기록

- [i-point]한컴, AI 솔루션 세미나 개최…기술 중심 전환·사례 소개

- [i-point]머큐리, 1분기 일시적 부진…와이파이7·위성으로 반등 '기대'

- [i-point]아이즈비전, 매출 124억 달성…전년비 29.8% 증가