Hanwha buys remaining stake in chemical business from Samsung Hanwha General Chemical to be almost wholly owned by conglomerate’s two affiliates

Translated by Ryu Ho-joung 공개 2021-06-28 07:35:54

이 기사는 2021년 06월 28일 07시24분 thebell에 표출된 기사입니다

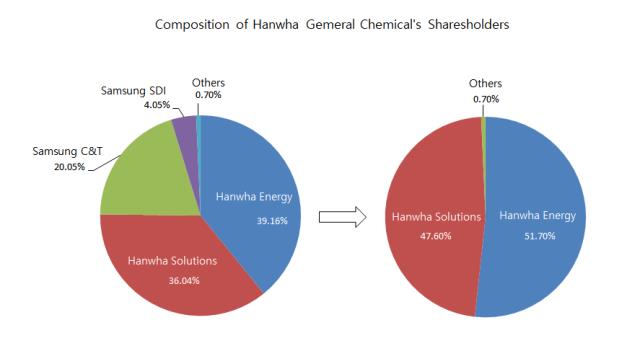

Hanwha General Chemical is set to be wholly owned by Hanwha Group six years after the defense and energy-focused conglomerate acquired Samsung Group’s defense and chemical businesses in a landmark deal worth 2 trillion won ($1.77 billion) in 2015.Hanwha Energy and Hanwha Solutions announced in filings on Thursday that their boards of directors approved the purchase of 20.05% and 4.05% stakes in Hanwha General Chemical – formerly Samsung General Chemical – held by Samsung C&T and Samsung SDI, respectively, for 1 trillion won.

The two Hanwha affiliates will buy 11.56% and 12.55% stakes, respectively, increasing Hanwha Energy and Hanwha Solutions’ ownership interest in Hanwha General Chemical to 51.7% and 47.6%.

As part of the agreement in 2015, Samsung had the right to sell the remaining holdings in the chemical company to Hanwha if the company does not go public until April 2022. Hanwha also had the right to buy the company’s stake held by Samsung affiliates. The announced transaction, however, was a separate deal between the two conglomerates, according to sources.

Now that Hanwha General Chemical is almost fully controlled by Hanwha affiliates, the chemical company could resume dividends – which it stopped for the past six years – serving as a cash cow for Hanwha Energy and Hanwha Solutions, industry watchers said.

Hanwha General Chemical has an annual capacity to produce around two million tons of purified terephthalic acid. Its operating profit margin has recorded a two-digit growth every year on a non-consolidated basis, increasing to over 30% in 2017 and 2018.

The company’s retained earnings also increased significantly due to strong income growth and no dividend payments, from 775 billion won at the end of 2015 to more than 2.7 trillion won at the end of 2020 on a non-consolidated basis.

A majority of the dividends paid by Hanwha General Chemical will go to Hanwha Energy, which will become the largest shareholder in the company with a 51.7% stake after the transaction between Hanwha and Samsung is completed in July. Hanwha Energy is 100% owned by H-Solution Corp, which is wholly controlled by Hanwha Solutions president Kim Dong-kwan and his two brothers.

Dong-kwan, the eldest son of Hanwha Group chairman Kim Seung-yeon, has been raising his stake in Hanwha Corp, the conglomerate’s de facto holding company, through H-Solution as part of a succession plan. Dividend payments by Hanwha General Chemical could mean more financial resources for him to build a shareholding in Hanwha Corp.

Dong-kwan had a 4.44% stake in Hanwha Corp at the end of March this year, versus a 22.65% stake held by his father. (Reporting by Ki-soo Park)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- [유증&디테일]상장 후 첫 조달나선 씨이랩, 주주반응 '글쎄'

- 존재감 살아있는 한화시스템 ICT, '필리' 손실 메운다

- KIST·M83, 인공지능 기반 3D 객체 식별 기술 '맞손'

- [i-point]엔젤로보틱스, ‘2025 한+노르딕 혁신의 날’에 웨어러블 기술 발표

- [i-point]아이티센피엔에스, 1분기 매출 559억… '양자내성 지갑'으로 성장 예고

- [i-point]딥노이드, KMI와 ‘검진 결과판정 AI 모니터링’ MOU

- [i-point]에스넷시스템, 1분기 매출 전년비 7% 증가한 794억 달성

- '미래에셋 키맨' 장의성, 파르나스 '더 세이지' 이끈다

- [스튜어드십코드 모니터]더제이운용 의결권 행사, 뚜렷한 보수적 기조

- 케이클라비스운용, NPL 2호 설정 매듭…지방은행 출자 참여