Hanwha Energy’s fundraising seen as part of succession planning Hanwha’s energy arm is wholly owned by third generation of the controlling Kim family

Translated by Ryu Ho-joung 공개 2022-04-08 08:05:52

이 기사는 2022년 04월 08일 08시04분 thebell에 표출된 기사입니다

Hanwha Energy, Hanwha Group’s energy arm that is wholly owned by the third generation of the controlling Kim family, is considering raising money externally through a private placement, a move seen as part of the South Korean conglomerate’s succession planning.Woori Private Equity is in talks to invest about 160 billion won ($131.2 million) in the company’s solar power projects in Australia by acquiring a 20% stake in the company, industry sources said.

Hanwha Energy began its solar power business in Australia in 2016, when it made equity investments in solar projects totaling 135 megawatts in Queensland and Victoria. It created its Australian solar subsidiary in February 2018, and also participated in a 202 MW solar development project in New South Wales.

Woori PE’s investment will help Hanwha Energy strengthen its foothold in the Australian renewable energy market. The Seoul-based private equity firm recently started fundraising, with many institutional investors reportedly showing interest as the investment is in line with ESG (environmental, social and governance) considerations. The deal, if signed, is expected to close in the next two to three months.

Hanwha Solutions, another affiliate of Hanwha Group, has been most active in raising capital from outside investors. It offloaded 49% of its polyvinyl chloride subsidiary in Ningbo, China, to Heimdall Private Equity earlier this year, and recently agreed to sell a 49% stake in its advanced materials business to Glenwood Private Equity.

The most notable difference between the two companies is that Hanwha Solutions is a publicly-traded company with Hanwha Corp, the conglomerate’s holding company, as its largest shareholder with a 36.23% stake, whereas Hanwha Energy is a privately-held company that is 100% owned by three sons of Hanwha Group chairman Kim Seung-youn.

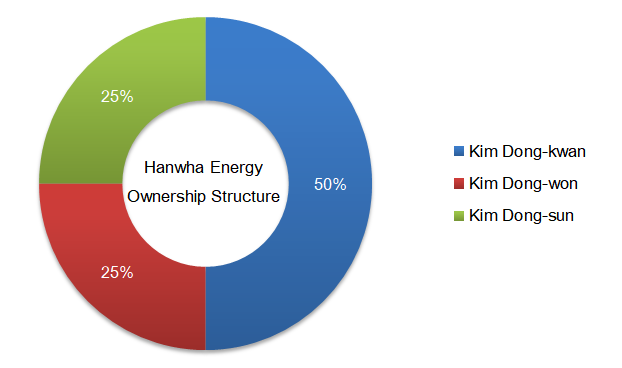

Kim Dong-kwan, the eldest of the three and president of Hanwha Solutions, is the largest shareholder of Hanwha Energy with a 50% stake. His two younger brothers – Dong-won, executive vice president of Hanwha Life Insurance, and Dong-sun, managing director of Hanwha Hotels & Resorts – each own 25% of the company.

Hanwha Energy, which is expected to play a key role in the conglomerate’s succession planning, purchased shares in the holding company in the open market in October last year. The transaction raised its stake to 9.7%, making Hanwha Energy the second largest shareholder of Hanwha Corp behind the group’s chairman, who owns 22.65% of the holding company.

It is likely Hanwha Energy will use the proceeds raised from a stake sale in its Australia solar business not only for business expansion but for other purposes related to succession planning, industry watchers said. (Reporting by Gyoung-tae Kim)

< 저작권자 ⓒ 자본시장 미디어 'thebell', 무단 전재, 재배포 및 AI학습 이용 금지 >

관련기사

best clicks

최신뉴스 in 전체기사

-

- [i-point]큐브엔터, 매출액 400억대…광고·MD부문 견인

- 스톤브릿지캐피탈, 플라스틱 컴파운드 '폴리피아' 품는다

- [키스트론 IPO]제2의 고려제강 노린다…오너 승계 목적은 "과도한 해석"

- [i-point]바이오솔루션, 200% 무상증자 결정

- 레이, 창사 이래 첫 1분기 흑자…매출도 신기록

- [i-point]DS단석, 일본 코스모 오일과 SAF용 전처리 원료 납품 계약 체결

- [DS금융그룹 시대 개막]디에스증권 '자본 확충' 효과까지…체질개선 노린다

- [삼성그룹 북미 대관조직 분석]강해지는 트럼프 압박, 늘어나는 로비 금액

- [i-point]신테카바이오, 1분기 매출 9억 '턴어라운드'

- [저축은행 서민금융 리포트]'CSS'에 진심인 OK저축, 중금리로 수익·건전성 관리